Investing is a crucial aspect of financial planning, and bonds have long been a staple in investment portfolios. Whether you’re a seasoned investor or a beginner, understanding bonds can help you make informed decisions about your financial future. This article explores what bonds are, how they work, their different types, risks and rewards, and whether they are a good investment for you.

What Are Bonds?

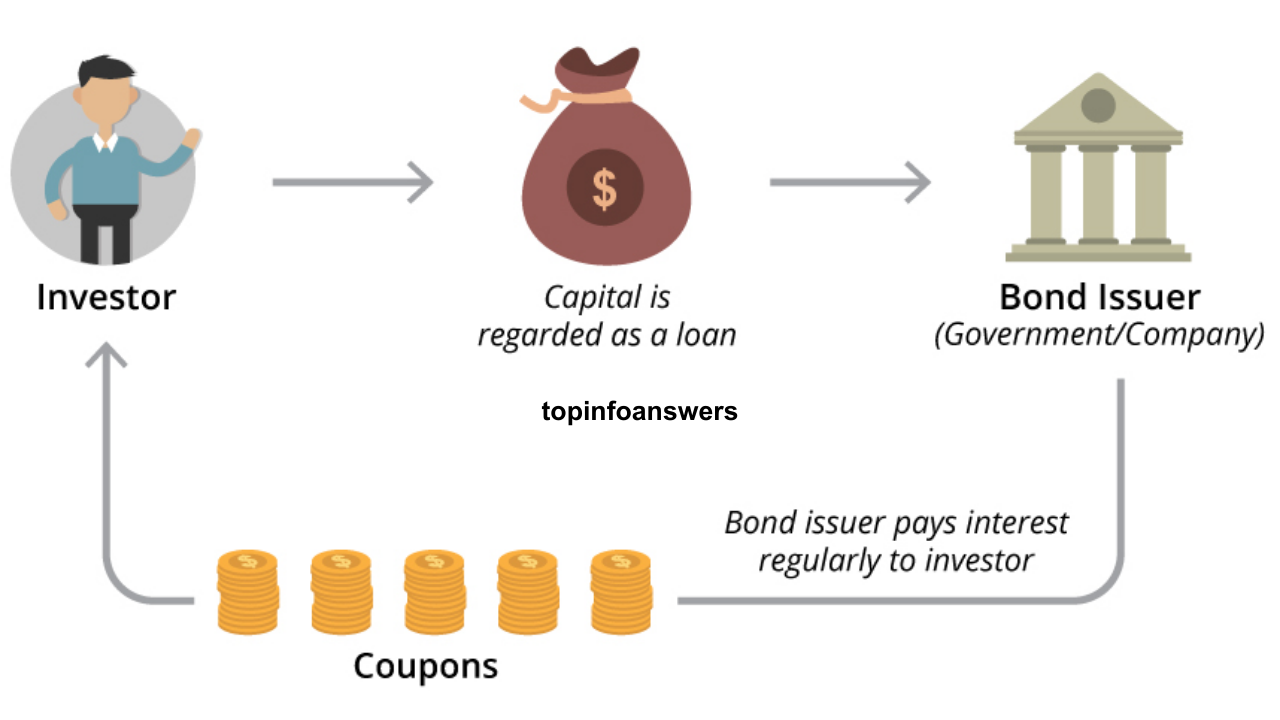

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically a corporation or government. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount when the bond matures. Bonds are often considered a safer investment compared to stocks because they provide predictable income streams and lower volatility.

How Do Bonds Work?

When an entity issues a bond, it sets specific terms, including:

- Face Value (Par Value): The amount the bondholder receives when the bond matures.

- Coupon Rate: The interest rate the issuer pays annually or semi-annually.

- Maturity Date: The date when the issuer repays the principal amount.

- Issuer: The entity responsible for repaying the bondholder.

Bond prices fluctuate based on interest rates, credit ratings, and economic conditions. They can be bought at par, at a discount, or at a premium depending on market demand.

Types of Bonds

Bonds come in various forms, each catering to different investor needs. The main types include:

1. Government Bonds

Issued by national governments, these bonds are considered low-risk investments. Examples include:

- U.S. Treasury Bonds (T-Bonds): Backed by the U.S. government, offering fixed interest payments.

- Municipal Bonds (Munis): Issued by state and local governments, often tax-free.

- Sovereign Bonds: Issued by foreign governments, carrying varying levels of risk.

2. Corporate Bonds

Issued by corporations to fund business operations, these bonds vary in risk levels based on the company’s financial health. They include:

- Investment-Grade Bonds: Issued by financially stable companies.

- Junk Bonds (High-Yield Bonds): Offer higher returns but come with greater risk.

3. Zero-Coupon Bonds

These bonds do not pay periodic interest but are sold at a deep discount. The investor profits by receiving the full face value at maturity.

4. Convertible Bonds

These bonds can be converted into a specified number of company shares, offering potential for higher returns.

5. Inflation-Linked Bonds

Designed to protect against inflation, these bonds adjust their principal value based on inflation rates.

Risks Associated with Bonds

Despite being considered a safer investment than stocks, bonds still carry risks, including:

1. Interest Rate Risk

Bond prices are inversely related to interest rates. When interest rates rise, bond prices fall, and vice versa. This risk affects long-term bonds more than short-term ones.

2. Credit Risk (Default Risk)

If the issuer fails to make interest payments or repay the principal, bondholders may suffer losses. Government bonds have lower credit risk compared to corporate bonds.

3. Inflation Risk

Inflation reduces the purchasing power of fixed-interest payments, making bonds less attractive during inflationary periods.

4. Liquidity Risk

Some bonds may not be easily tradable in the market, making it difficult for investors to sell them at desired prices.

5. Reinvestment Risk

If interest rates decline, investors may have to reinvest their returns at lower rates, reducing overall earnings.

Rewards of Investing in Bonds

1. Stability and Predictable Income

Bonds provide regular interest payments, making them a stable source of income, especially for retirees.

2. Portfolio Diversification

Adding bonds to an investment portfolio helps reduce overall risk by balancing the volatility of stocks.

3. Capital Preservation

Investors seeking to preserve their principal often prefer bonds, particularly government and high-quality corporate bonds.

4. Tax Benefits

Some bonds, like municipal bonds, offer tax-free interest income, making them attractive for investors in high tax brackets.

Bonds vs. Other Investments

1. Bonds vs. Stocks

Stocks offer higher potential returns but come with increased volatility. Bonds, on the other hand, provide steady income with lower risk.

2. Bonds vs. Real Estate

Real estate investments require significant capital and maintenance, whereas bonds offer passive income with lower involvement.

3. Bonds vs. Fixed Deposits (FDs)

Bonds generally offer better returns than bank fixed deposits but come with market risks, whereas FDs provide guaranteed returns with lower yield.

Are Bonds a Good Investment for You?

Determining whether bonds are a good investment depends on several factors, including your financial goals, risk tolerance, and investment horizon.

1. Ideal for Conservative Investors

If you prioritize stability and steady income over high returns, bonds are a suitable choice.

2. Useful for Portfolio Balancing

For investors with a stock-heavy portfolio, bonds provide a cushion against market volatility.

3. Suitable for Retirement Planning

Bonds help retirees generate regular income without exposing them to stock market fluctuations.

4. Consider Economic Conditions

In a rising interest rate environment, bond prices decline, making them less attractive. Conversely, in a declining rate scenario, bonds perform well.

How to Invest in Bonds

Investors can buy bonds through various channels, including:

- Government Bond Portals: Many governments offer online platforms for direct bond purchases.

- Stock Exchanges: Corporate and government bonds are traded like stocks.

- Mutual Funds and ETFs: Bond funds provide diversification without requiring direct bond selection.

- Financial Advisors: Professional guidance can help in choosing the right bonds based on risk appetite and investment goals.

Bonds are a fundamental component of a well-diversified investment portfolio. They offer stability, predictable income, and capital preservation, making them an excellent choice for risk-averse investors. However, they also carry risks such as interest rate fluctuations and inflation impact. Understanding these dynamics will help you make informed investment decisions.

If you’re looking for a safer investment option with steady returns, bonds are worth considering. However, balancing them with stocks and other assets is crucial for optimal portfolio performance. As always, thorough research and professional advice can help tailor your investment strategy to meet your financial objectives.

Leave a Reply